Safe and Easy Pawn Transactions for First-timers

For many people, the thought of pawning an item for the first time can be intimidating. Concerns about safety, understanding the process, and getting a fair deal are common but can be easily addressed with the right information. Knowing what to expect can turn a potentially stressful experience into a smooth and straightforward transaction.

Understanding How Pawn Shops Work

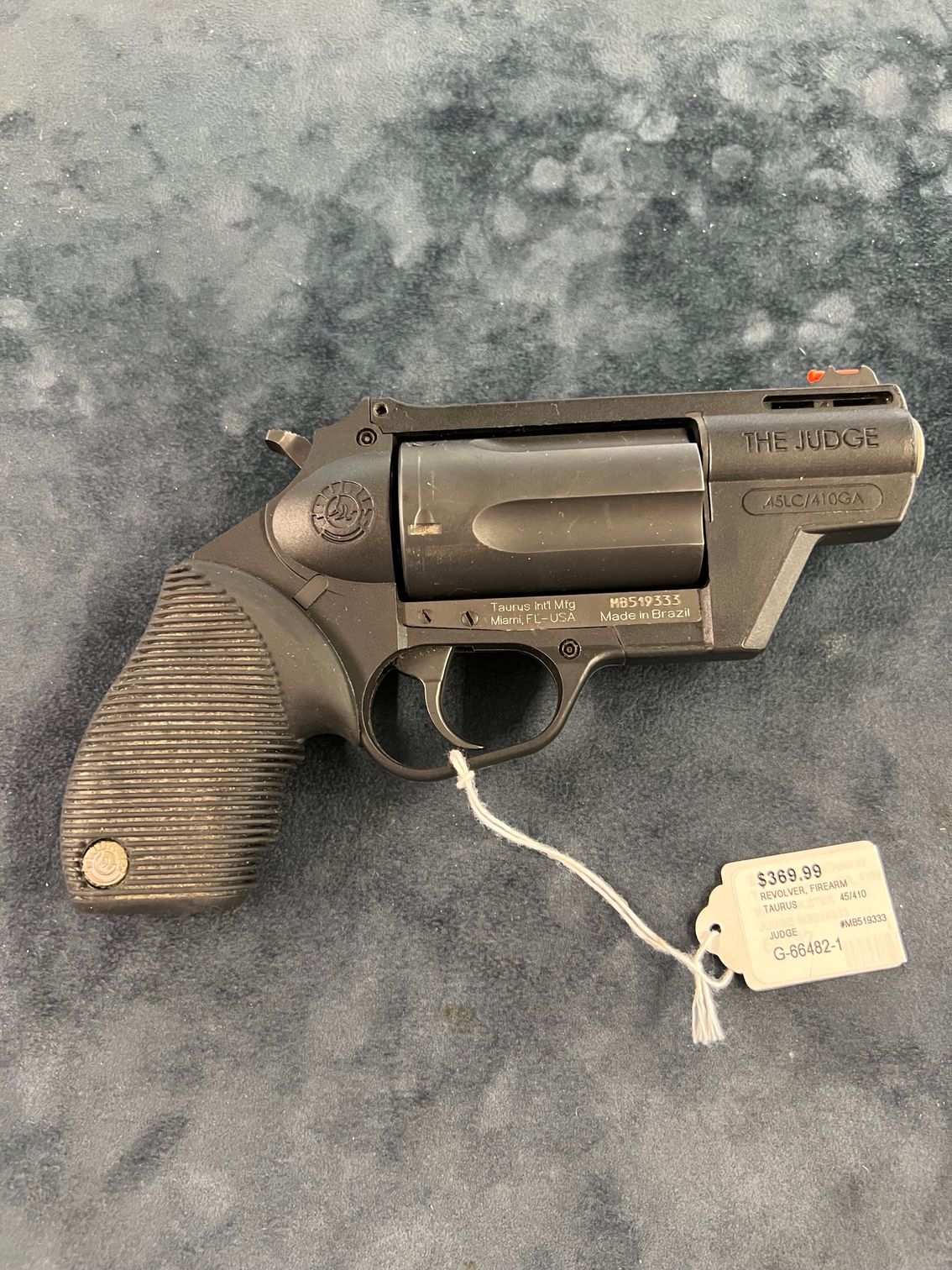

Pawn shops provide a way to get loans quickly by using personal items as collateral. The process is simple and secure. You bring an item of value, such as jewelry, electronics, or tools, to the pawn shop. An appraiser evaluates the item to determine its worth. This evaluation is based on factors like market value, condition, and demand.

Once the value is determined, you can receive a loan amount based on a percentage of the appraised value. You then get a loan ticket that outlines the loan terms, interest rate, and repayment schedule. It’s crucial to read and understand these terms before finalizing the loan.

Your item remains in the pawn shop’s secure storage until the loan is repaid. If you repay the loan within the agreed timeframe, you get your item back. If you can’t repay the loan on time, many pawn shops offer extensions or renewals for an additional fee. If the loan is not repaid, the pawn shop keeps the item to recover the loan amount by reselling it. This straightforward process makes pawn shops a reliable option for getting quick cash.

Preparing Your Item for Pawning

Taking the time to prepare your item can help you get the best valuation possible. Here are steps to ensure your item is pawn-ready:

- Clean Your Item: Make sure your item is clean and presentable. For example, polish jewelry, wipe down electronics, and clean antique pieces. A clean item looks more valuable and can attract a better offer.

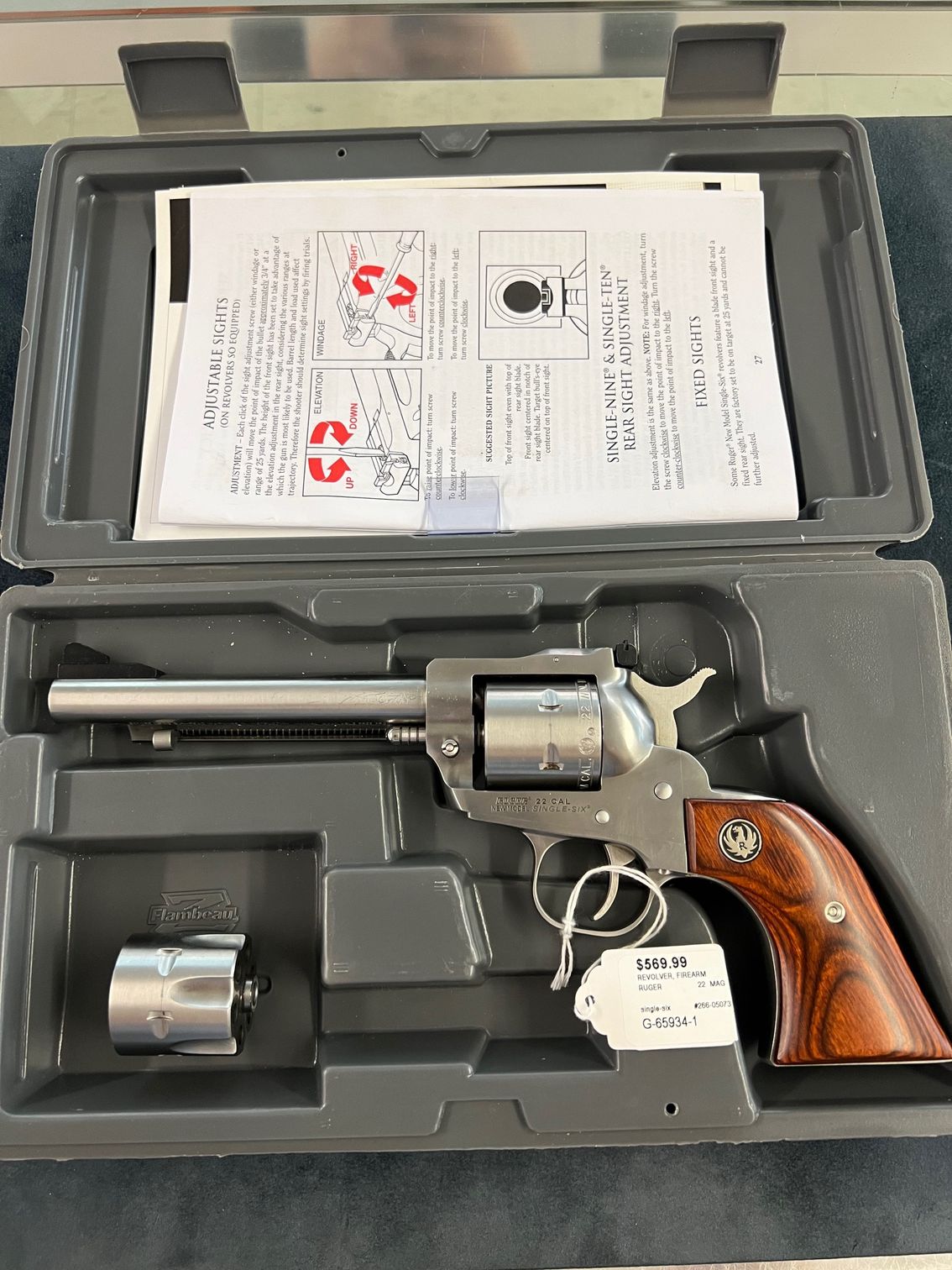

- Gather Documentation: If you have any documentation, like receipts, certificates of authenticity, or original packaging, bring them with you. This additional information can help verify the item's value and make the appraisal process smoother.

- Check Functionality: Ensure your item is in good working condition. Test electronics to confirm they function properly, and check that jewelry is intact without any missing pieces. Functioning items are appraised higher than those that need repairs.

- Research Value: Have a general idea of your item's market value. This research can help you gauge if the pawn shop's offer is fair. Look up similar items online or get an estimate from a reliable source.

- Prepare ID: Bring a valid form of identification. Pawn shops are required by law to verify the identity of the person pawning an item. This ID is essential for the loan process to proceed smoothly.

By following these steps, you can increase the likelihood of receiving a fair valuation and make the pawning process more efficient. Proper preparation helps ensure that you get the maximum value for your item, leading to a more favorable loan agreement.

What to Expect During the Transaction

The pawn transaction process is straightforward. When you arrive at the pawn shop, an appraiser will evaluate your item. This appraisal assesses the item's condition, market demand, and value. The appraiser might also check authentication marks or test the functionality of the item. This step ensures an accurate valuation.

Once the appraisal is complete, the pawn shop will make an offer based on the appraised value. You can accept, decline, or negotiate the offer. It's helpful to know the market value of your item beforehand to ensure the offer is fair. After agreeing on the loan amount, you'll review and sign a loan agreement. This document outlines the loan terms, interest rate, repayment schedule, and any fees associated with the loan.

After signing the agreement, you receive your cash immediately. The pawn shop will securely store your item until the loan is repaid. Remember to keep your loan ticket safe, as you’ll need it to reclaim your item. The transaction process is designed to be quick and hassle-free, making it easy for first-timers to navigate.

Tips for a Smooth Pawn Experience

To ensure your pawn transaction goes smoothly, consider the following tips:

- Choose a Reputable Pawn Shop: Research and select a well-reviewed pawn shop known for fair practices and good customer service. This can make a significant difference in your experience.

- Understand Loan Terms: Carefully read the loan agreement. Make sure you understand the interest rates, repayment schedule, and any additional fees. Ask questions if anything is unclear.

- Negotiate Confidently: Don’t be afraid to negotiate the offer. If you believe your item is worth more, provide evidence and make your case. Effective negotiation can improve the terms of your loan.

- Plan Repayment: Have a clear plan for repaying the loan within the agreed terms. Timely repayment ensures you can retrieve your item and avoid additional fees.

- Keep Documentation Safe: Store your loan ticket and any related documents securely. This ticket is essential for reclaiming your item once the loan is repaid.

By following these tips, you can make your first pawn transaction safe, easy, and beneficial. Preparation and understanding are key to a positive experience.

Conclusion

Pawning can be a simple and secure way to get quick cash using your valuable items as collateral. By understanding how pawn shops work, preparing your items properly, knowing what to expect during the transaction, and following tips for a smooth experience, first-timers can feel confident in their decisions. The process is designed to be transparent and user-friendly, ensuring you get the best value for your items and a fair loan agreement.

If you’re in Kentucky and considering pawning an item, River City Pawn is here to help. We offer a trustworthy and efficient service, ensuring you receive the best rates for your valuables. Visit one of our locally owned

pawn shops in Owensboro, KY to experience a secure and straightforward transaction.

Locations in:

Owensboro, Henderson, Madisonville, Leitchfield, Murray, Princeton, KY

All Rights Reserved | Website Designed and Developed By Oddball Creative