Common Pawn Shop Myths Debunked

Many misconceptions surround the pawn shop industry, causing people to hesitate when considering pawning as a viable financial option. These myths often paint an inaccurate picture of what it’s really like to use pawn services, leading to unnecessary fear and skepticism. It's important to address these misunderstandings and present the truth so that everyone can make informed decisions when they need quick cash.

Pawn shops are often viewed in a negative light due to stereotypes and misconceptions. However, they offer valuable services and provide immediate financial relief without the risks that come with borrowing from high-interest lenders or payday loan companies. The reality is that pawn shops offer a secure, regulated way to obtain a short-term loan using personal items as collateral.

By debunking these common myths, we can better understand the true benefits of pawning. Many people from all walks of life can benefit from the services provided by reputable pawn shops. In this article, we will explore and correct several myths about pawning that may be keeping people from utilizing this convenient option.

Myth 1: Pawn Shops Offer Low Valuations

One common myth is that pawn shops undervalue items, giving you far less than what they're worth. This misconception can deter people from even considering pawning as an option. However, reputable pawn shops, such as those in the River City Pawn chain, strive to provide fair and competitive valuations.

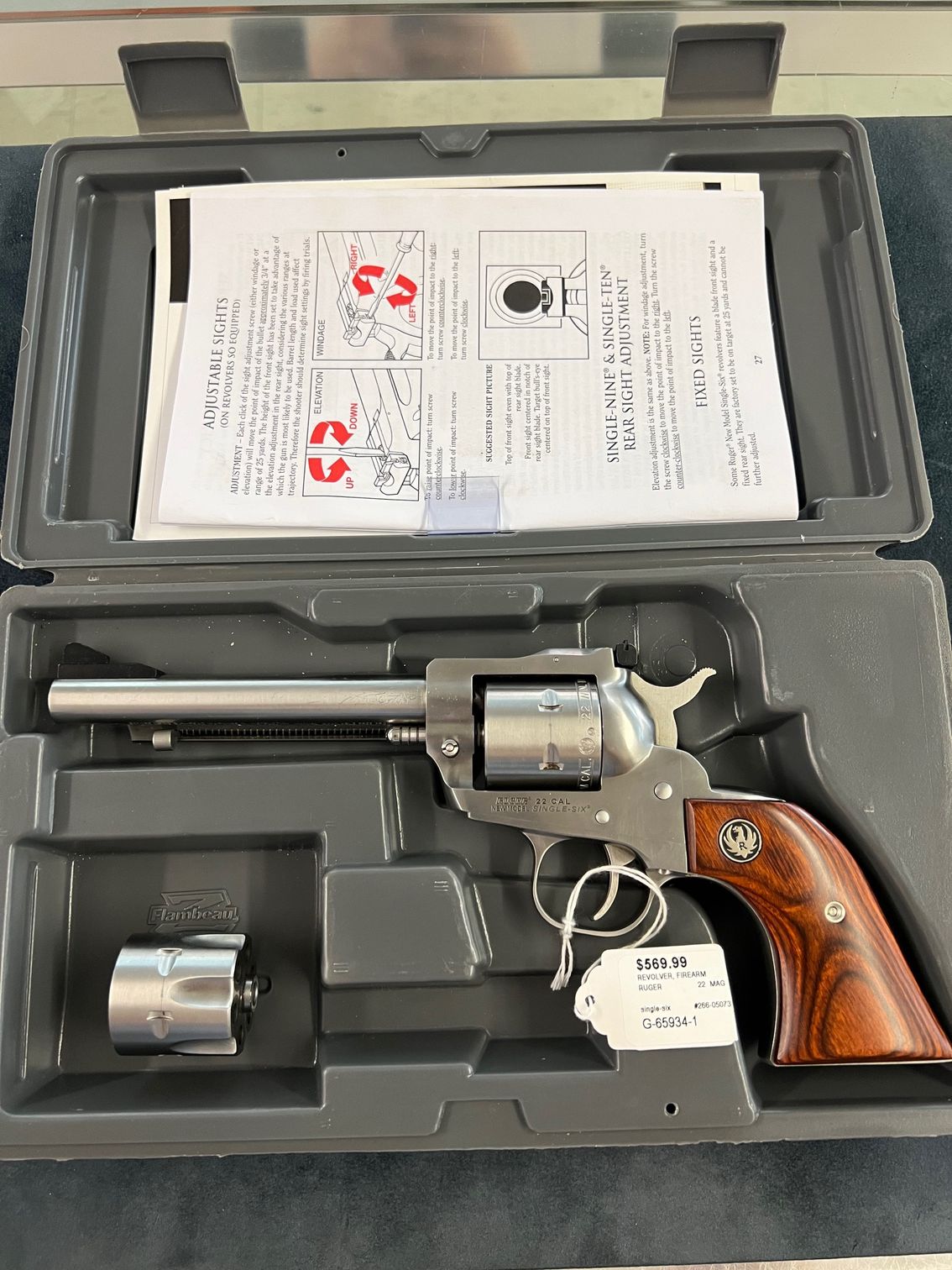

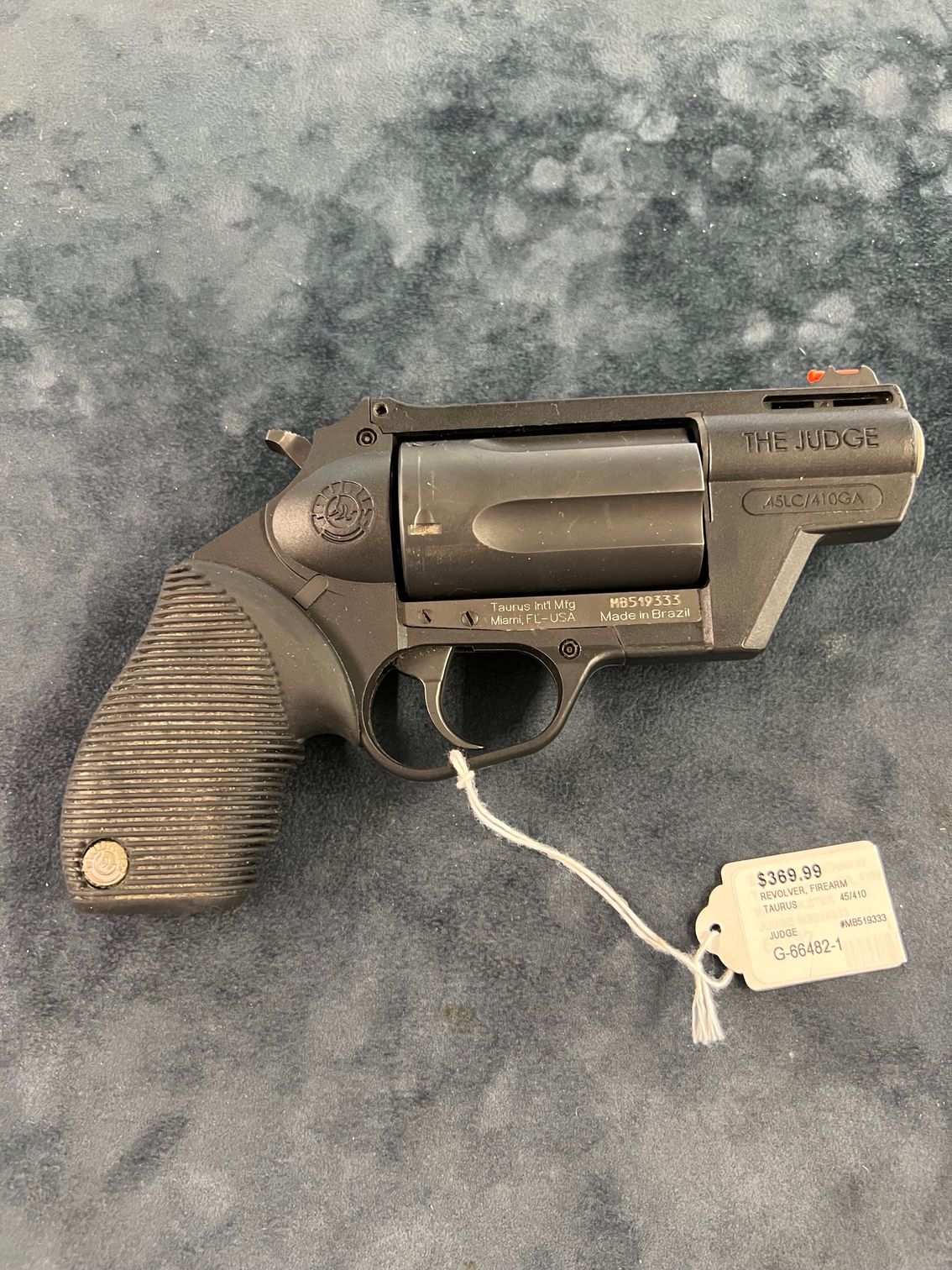

Experienced appraisers assess each item based on market value, condition, demand, and brand. Their goal is to offer valuations that reflect the true worth of the items. This benefits both the pawn shop and the customer, as fair valuations help build trust and encourage repeat business. For example, luxury watches, gold jewelry, and high-quality electronics can fetch substantial loan amounts because these items hold strong value in the resale market.

Moreover, many pawn shops use advanced tools and databases to determine accurate prices. They compare recent sales data from various platforms to ensure their offers are competitive. This thorough evaluation process ensures that customers receive a fair loan amount equivalent to the item's worth. So next time you're considering pawning an item, know that reputable pawn shops work hard to provide you with a fair deal.

Myth 2: Pawning is Only for Desperate People

Another myth that needs debunking is the belief that pawning is only for desperate individuals or those in financial distress. This couldn't be further from the truth. People from all walks of life use pawn shops for various reasons, and it’s not just about financial emergency.

Here are some reasons why people choose to pawn their items:

1. Quick Access to Cash: Sometimes, people need immediate cash for time-sensitive opportunities or emergencies. Pawning provides a quick and efficient way to get these funds without the lengthy approval processes of traditional loans.

2. Avoiding Credit Checks: Pawning allows individuals to avoid impacting their credit score. Since pawn loans don't require credit checks, this option is appealing to those who prefer not to go through conventional banking systems.

3. Temporary Financial Solution: Some people use pawning as a way to solve temporary cash flow issues. For example, small business owners may pawn valuable items to cover short-term expenses, knowing they can repay the loan and retrieve their items once their cash flow stabilizes.

4. Storage Option: Believe it or not, some individuals pawn items they don't use regularly as a form of secure storage. This way, their valuables are kept safely until they need them again, and they get cash in the meantime.

These examples illustrate that pawning is a versatile financial tool used by a diverse range of people. It offers numerous benefits beyond the stereotype of being a last resort for the desperate.

Myth 3: It's Hard to Get Your Items Back

A common misconception is that it’s difficult to reclaim items once they’ve been pawned. However, the process of getting your items back is straightforward and well-documented. When you pawn an item, you enter into a loan agreement that clearly defines the terms, including the loan duration, interest rates, and repayment schedule.

To retrieve your item, you simply need to repay the loan amount plus any accrued interest within the agreed time frame. Most pawn shops offer flexible payment plans and even provide extensions if you need more time. Contrary to the myth, pawnshops aim to make the redemption process as seamless as possible because they understand that satisfied customers are likely to return for future transactions.

Moreover, reputable pawnshops keep your items securely stored and in the same condition as when they were pawned. This ensures that when you come back to reclaim your belongings, they are just as you left them. So, reclaiming pawned items is neither complicated nor risky, as long as you abide by the terms outlined in your loan agreement.

Myth 4: Pawned Items Are Likely Stolen

Another myth about pawning is the erroneous belief that pawnshops commonly deal in stolen goods. Reputable pawnshops adhere to strict regulations and protocols designed to prevent this. In fact, they work closely with local law enforcement agencies to ensure that any stolen items are not accepted.

When an item is pawned, the shop records detailed information about the item and the person pawning it. This includes taking a valid ID and often a fingerprint. These records are then entered into a database that can be accessed by law enforcement to cross-check against reports of stolen items. This thorough documentation process helps to ensure that items accepted by pawnshops are not linked to any criminal activity.

Furthermore, pawnshops are subject to regular audits and inspections to ensure compliance with these regulations. The industry takes this responsibility seriously as it affects their reputation and trustworthiness. Hence, the belief that pawned items are likely stolen is unfounded, especially with the stringent measures in place.

Conclusion

By debunking these common myths about pawnshops, we hope to provide you with a clearer and more accurate understanding of the valuable services they offer. Far from being shady or untrustworthy, reputable pawnshops in Kentucky, like River City Pawn, strive to offer fair valuations, cater to a wide range of customers, make it easy for you to reclaim your items, and adhere to strict regulations to prevent dealing in stolen goods.

Pawning can be a smart and flexible financial option for many people. Whether you need quick cash, want to avoid credit checks, or simply need a temporary solution to a cash flow issue, pawning offers a secure and effective way to meet your needs.

If you're interested in learning more or need assistance, visit River City Pawn. Our

pawn shop in Owensboro, KY, is dedicated to offering more for your pawn, guaranteed! See for yourself why so many people in Western Kentucky trust us with their valuables.

Locations in:

Owensboro, Henderson, Madisonville, Leitchfield, Murray, Princeton, KY

All Rights Reserved | Website Designed and Developed By Oddball Creative