The Ins and Outs of Pawning: Understanding the Pawning Process at River City Pawn Shops

Pawn shops have long been recognized for their crucial role in providing short-term financing solutions to individuals in need of quick cash. In offering a straightforward, no-strings-attached approach to loans, pawn shops ensure those seeking temporary liquidity can access funds within a short period. As a trusted pawn shop in Kentucky, River City pawn shops offer customers the opportunity to pawn their valuable items for cash while enjoying competitive rates and exceptional service.

In this comprehensive guide, we aim to demystify the pawning process at River City pawn shops for our valued clients. We will provide you with essential information about the steps involved in pawning your valuable items, best practices for preparing goods for appraisal, and insider tips on how to obtain the most favorable loan terms. Whether you're new to the world of pawning or an experienced client looking for helpful insights, our in-depth guide seeks to empower you with a thorough understanding of the ins and outs of pawning at River City pawn shops.

Pawning your possessions can be a convenient and hassle-free way to access funds for a variety of purposes – be it covering an unexpected expense, jump-starting a business, or even funding a once-in-a-lifetime adventure. River City pawn shops in Kentucky stand committed to providing clients with an easy and reliable pawning experience, ensuring you can obtain the cash you require at a moment's notice without facing unnecessary hurdles, hidden fees, or excessive restrictions. By adhering to our expert advice and tips outlined in this guide, you'll be well-equipped to navigate the pawning process at River City pawn shops with confidence and ease.

Preparing Your Items for Pawning

Before heading to River City pawn shops to secure a loan using your valuable items, it's essential to ensure they are ready for the appraisal process. Properly preparing your items can increase their perceived value, leading to a higher loan offer. Here are some crucial steps to take in preparation for pawning:

1. Clean and Polish: Ensure your items are looking their best by giving them a thorough cleaning and polish. For delicate or intricate items, a gentle approach is necessary to avoid damage.

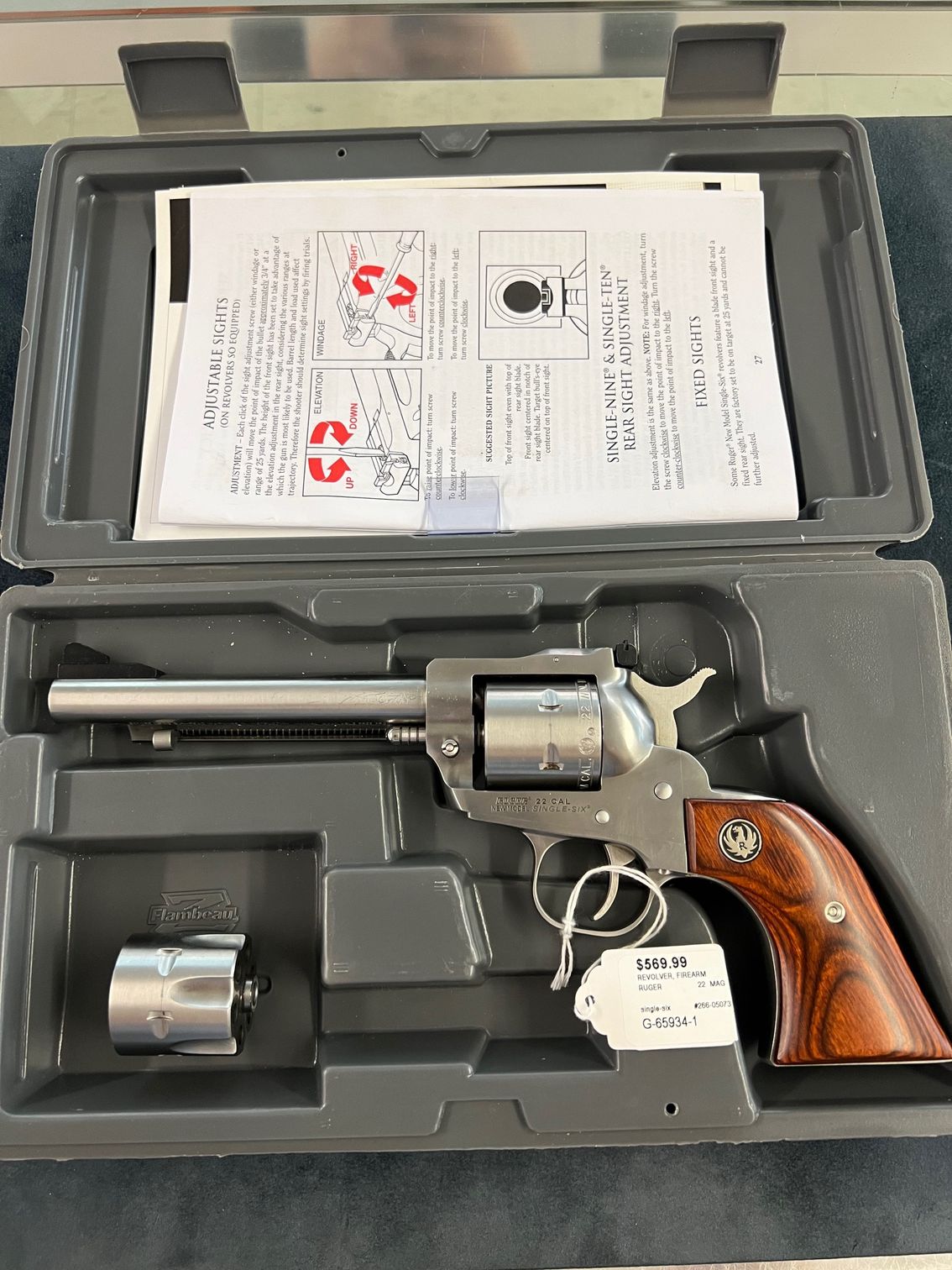

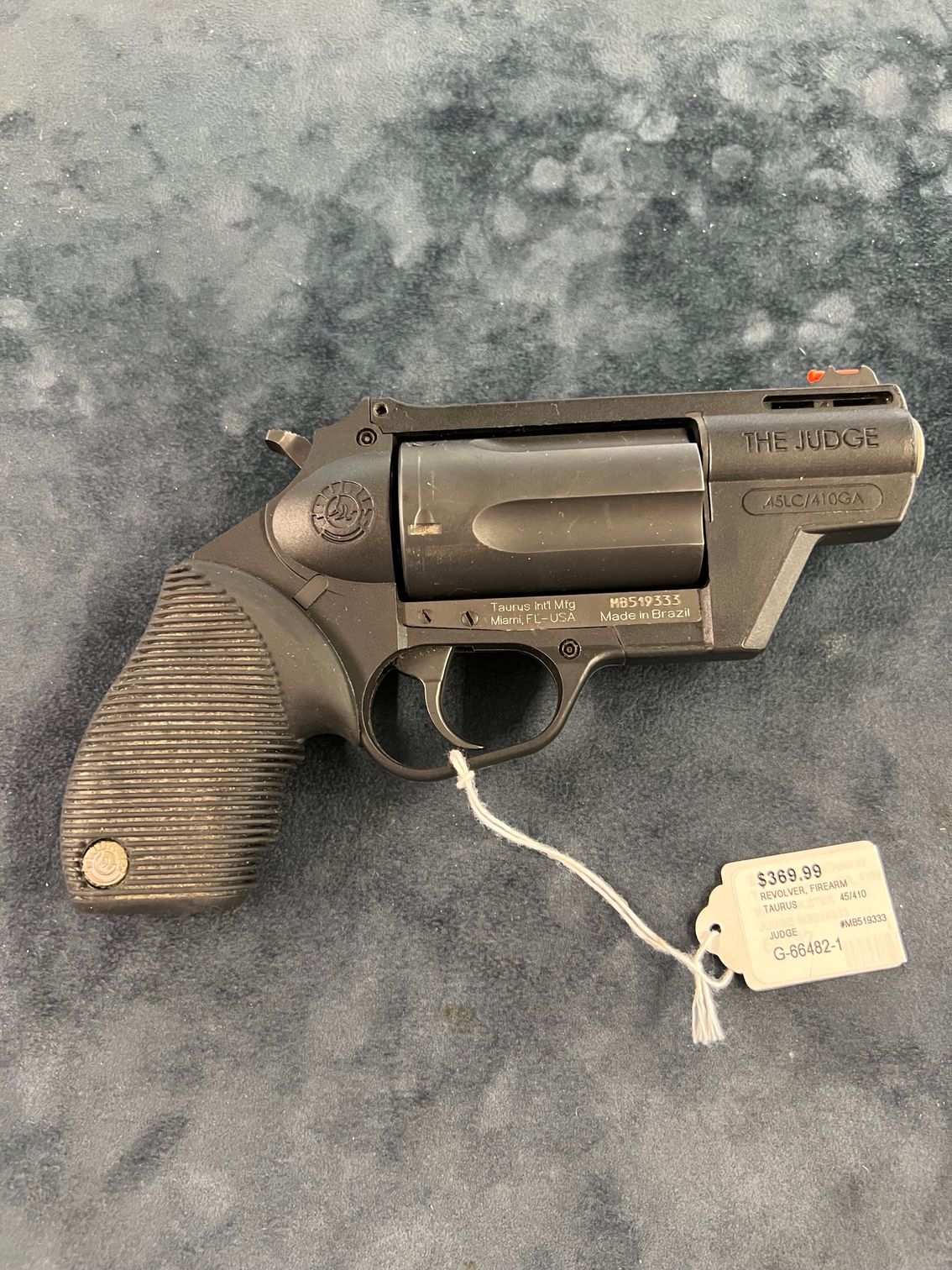

2. Gather Documentation: If you have relevant documentation, such as receipts, certificates of authenticity, or original packaging, make sure to bring them with you. Such materials can impact the appraisal outcome and increase an item's value.

3. Assess Functionality: If you're pawning items with electronic or mechanical components, ensure they are in working condition. Pawnbrokers will likely test the functionality of your items before making a loan offer.

Understanding the Appraisal Process

At River City pawn shops, professional appraisers assess your items to determine their worth. This process consists of examining several factors that contribute to an item's value. As you navigate the pawning process, it's helpful to know the aspects that pawnbrokers consider during the appraisal:

1. Condition: The state of your items plays a significant role in determining their value. Pawnbrokers look for signs of wear, damage, or repair during the appraisal.

2. Market Demand: If your item is highly sought-after or in high demand, it could fetch a higher loan offer.

3. Rarity and Uniqueness: Rare, unique, or limited-edition items often hold a higher value than more common counterparts.

4. Precious Metal or Gem Content: For jewelry or other items containing precious metals or gemstones, appraisers will consider the weight, quality, and current market prices of these materials.

Negotiating Loan Terms and Interest Rates

Once you receive a loan offer from River City pawn shops, be prepared to negotiate the terms and interest rates. While pawnshops are regulated and usually offer competitive rates, negotiation skills can help you secure the best deal possible. Follow these expert tips during negotiations:

1. Be Informed: Research current market values and trends for the items you're pawning. This knowledge will empower you during negotiations.

2. Highlight Key Features: Emphasize any unique attributes or special features of your items to increase their value. Demonstrate the item's functionality and be prepared to answer any questions the pawnbroker may have about the item.

3. Be Willing to Compromise: Approach negotiations with an open mind and a willingness to compromise on fair terms.

Repaying Your Loan and Redeeming Your Items

After successfully receiving a loan from River City pawn shops, it's essential to understand the repayment process and terms. Typically, loans from pawn shops have a predetermined term – often 30 days – during which you're required to make interest payments. To redeem your items, keep these crucial pointers in mind:

1. Plan Your Repayments: Budget wisely and ensure you make timely interest payments to avoid defaulting on your loan.

2. Monitor Loan Term: Be aware of your loan's maturity date and make arrangements to pay off the full amount of the loan and accrued interest by the due date.

3. Extension or Renewal: If you cannot repay the loan in full by the due date, contact River City pawn shops to discuss options for extending or renewing the loan term. Be aware that additional fees or interest may apply in these cases.

Conclusion

The pawning process at River City pawn shops in Kentucky is designed to provide customers with an accessible and hassle-free method of obtaining short-term financing using valuable items. By following our in-depth guide covering all aspects of the pawning process, you'll be well-equipped to secure a favorable loan offer, negotiate the best terms, and redeem your cherished possessions seamlessly. Understanding the ins and outs of pawning at River City

pawn shops in Henderson, KY, empowers you to leverage the value of your valuables, access the funds you need in a pinch, and meet your financial goals in a timely and convenient manner.

Locations in:

Owensboro, Henderson, Madisonville, Leitchfield, Murray, Princeton, KY

All Rights Reserved | Website Designed and Developed By Oddball Creative