The Complete Beginner's Guide to Pawning at River City Pawn Shops - Unlocking the Value of Your Items

Are you considering pawning items for the first time and curious about how it works at River City Pawn? Whether you're in need of short-term financial assistance or want to declutter your home, pawning can be an excellent solution. In this complete beginner's guide, we will walk you through the entire process of pawning items at River City Pawn, sharing crucial tips and insights to help you make informed decisions and get the best possible deal.

Pawning items doesn't have to be an overwhelming or complicated process. With a little knowledge and understanding of the pawning process, you'll be well-prepared to navigate the world of pawnshops with confidence. This comprehensive guide covers everything from appraising your items to negotiating terms and understanding loan duration, repayment, and defaulting consequences. Read on to unlock the value of your items and get the most out of your River City Pawn experience.

1. Assessing and Preparing Your Items for Pawn

The first step in the pawning process is identifying which items you want to pawn. Take note of the items that yield the highest value in pawnshops. Once you've chosen your items, ensure they are in good condition and clean them thoroughly. Gather any relevant documentation, such as warranty cards, receipts, and certificates of authenticity, to help verify the item's value.

2. Appraising the Value of Your Items

Before bringing your items to River City Pawn, research their market value and consider seeking a professional appraisal if necessary. Websites like eBay and WorthPoint allow you to search for similar items recently sold, providing a rough estimation of your item's value. This information will help you better understand your item's worth, ensuring that you're well-prepared to negotiate with a pawnbroker.

3. Negotiating Terms at River City Pawn

When you arrive at River City Pawn, one of our experienced pawnbrokers will evaluate your items and make an offer. Here are some tips to keep in mind when negotiating:

- Remain Calm and Professional: Approach the negotiation as a friendly conversation, not a confrontation.

- Be Informed: Understanding the value of your items and being aware of current market trends will help you negotiate effectively.

- Be Open and Honest: Present all documentation and share any relevant information about the item's history or condition. Transparency and honesty can help establish trust with the pawnbroker.

- Don’t Be Afraid to Counter-Offer: If the pawnbroker's initial offer is lower than what you expected, present your research and reasoning to justify a higher amount.

- Be Prepared to Walk Away: While we strive to provide fair deals at River City Pawn, it's essential to be willing to walk away if you believe your item's value warrants a higher loan offer.

Keep in mind that both the loan amount and interest rate are negotiable. River City Pawn is committed to offering fair rates, but don't be shy about discussing these terms to reach an agreement that works for both parties.

4. Loan Duration, Repayment, and Extensions

Pawn loans at River City Pawn typically have a 30-day loan term. After this period, you must repay the loan principal plus any interest and fees to reclaim your pawned item. When repaying, make sure you have the pawn ticket that was provided when initiating the loan, as it serves as proof of ownership.

If you cannot repay the loan in full by the due date, River City Pawn may offer a loan extension. In this case, you'll be required to pay the interest accrued up until that point, and the loan term will be extended for another 30 days. Keep in mind that extending a loan means accruing additional interest, so it's in your best interest to repay the loan as quickly as possible.

5. Defaulting on Your Pawn Loan

If you cannot repay your pawn loan or agree to an extension, your pawned item will be considered in default, and River City Pawn will have the right to sell the item to recoup their losses. Defaulting on a pawn loan does not affect your credit score, and you are still welcome to engage in future transactions with River City Pawn.

6. Redeeming Your Pawned Item

Once you've repaid the loan in full, you can redeem your pawned item. Ensure you bring your pawn ticket and a valid government-issued ID when collecting your item. At River City Pawn, we store all pawned items securely, ensuring they are safe and well-maintained until you're ready to reclaim them.

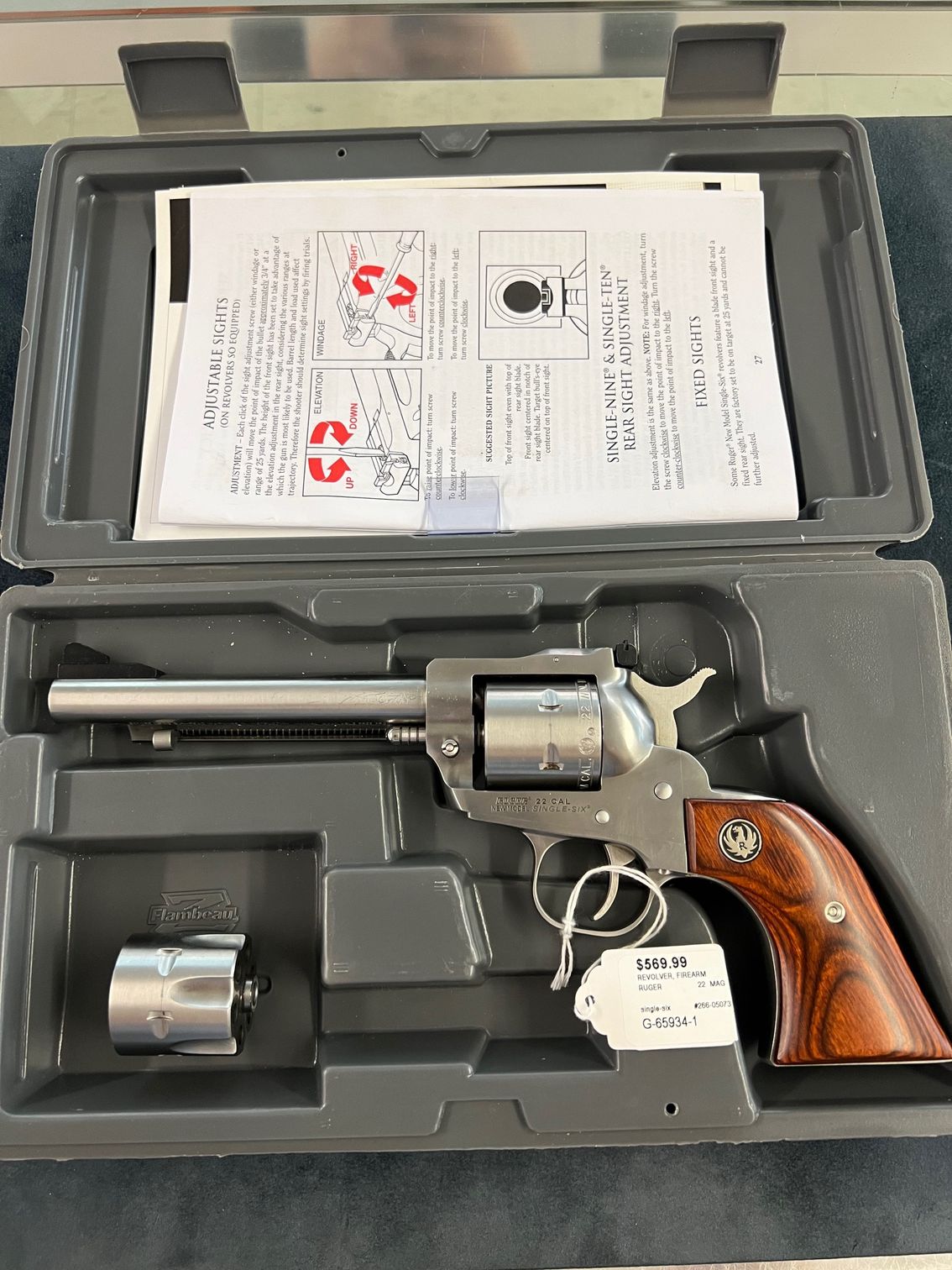

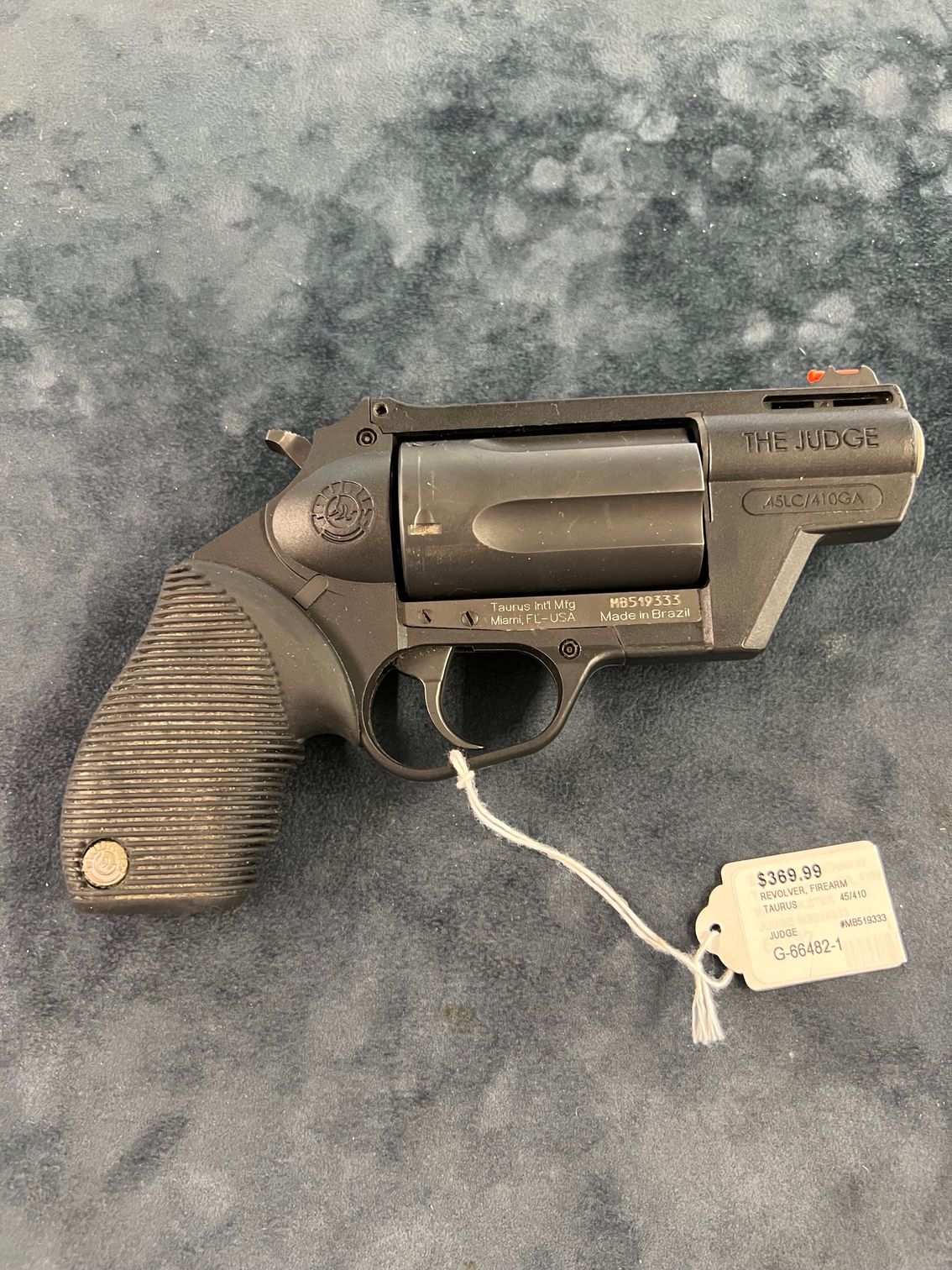

7. Selling vs. Pawning

In addition to pawning items for a loan, you can also opt to sell your items outright at River City Pawn. If you do not foresee a need to reclaim your item, selling may be a more suitable option. Discuss your needs with the pawnbroker and consider which option works best for your financial situation.

Unlock the Full Potential of Pawning at River City Pawn

Understanding the pawning process at River City Pawn empowers first-time customers to make informed decisions and get the best possible deal for their valued items. By preparing your items, researching their value, negotiating terms, and understanding repayment options, you can effectively navigate the pawn shop experience and benefit from the available opportunities.

Are you ready to take advantage of our easy, short-term financial solutions or sell your items? Visit one of our River City Pawn locations to discuss your needs with our professional and experienced pawnbrokers. With transparent evaluations and customized solutions, River City Pawn has you covered. You can also browse our extensive online inventory to discover great deals on high-quality pre-owned items.

Remember, pawning items at River City Pawn not only helps you unlock the value of your assets, support a locally-owned, community-oriented business, and contribute to a sustainable and circular economy. Take the first step towards a successful pawning experience and maximize the value of your assets by visiting

River City Pawn today.

Locations in:

Owensboro, Henderson, Madisonville, Leitchfield, Murray, Princeton, KY

All Rights Reserved | Website Designed and Developed By Oddball Creative